Start Here: A Tax‑Smart Roadmap to Sell Your Los Angeles Area Home (Introduction)

A smarter sale can save you tens of thousands in taxes, fees, and stress. If you’re an empty nester in Santa Monica, Westchester, or Woodland Hills, your timing, paperwork, and move plan matter as much as price. The goal is simple: sell efficiently, protect your equity, and land comfortably in your next home.

You’ll learn how to confirm your numbers, understand the capital gains exclusion for senior homeowners, leverage a Proposition 19 transfer, weigh a cash offer vs. listing, and map an easy move. For official local rules on tax-base transfers, see the Los Angeles County Property Tax Portal’s Prop 19 overview.

Ready to talk through your plan?Book a free 20‑minute consultation and get a tailored timeline for your sale and downsizing move.

Clarify Your Goals: Downsizing, Lower Maintenance, and Relocating Closer to Family or Healthcare

Start with your “why” so every decision supports it. Whether you want lower maintenance, a single‑level condo, or to live nearer a grandchild or doctor, clarity drives pricing, prep, and timing.

Write down your top two goals and a target move‑in date. Then identify must‑haves (elevator, secure parking, clinic proximity) versus nice‑to‑haves. Use a simple worksheet so you can weigh offers against your real priorities. Practical tips for right‑sizing come from AARP’s guidance on decluttering before a move: AARP’s 8 tips.

Know Your Numbers: Equity, Mortgage Payoff, and Estimated Net Proceeds in LA

Your net—not your price—funds your next chapter. Start with your expected sale price, subtract your mortgage payoff, then estimate closing costs, transfer taxes, and any credits.

Use city‑specific transfer tax info to avoid surprises. In LA County there’s a county tax and, in certain cities (including Santa Monica and Los Angeles), additional city transfer taxes may apply; confirm the exact schedule before you list. See the county’s documentary transfer tax page for rates and examples: LA County RR/CC Documentary Transfer Taxes.

-

- Mortgage payoff + liens: Request updated payoff figures from your lender well in advance

- Closing/escrow/title: Get a written estimate from escrow for your address and price point

- Transfer/recording taxes: Verify city add‑ons for Santa Monica or Los Angeles using the county link above

- Repairs/credits: Budget for buyer credits after inspections

Tax Basics for Seniors: Capital Gains Exclusion for Senior Homeowners Explained

Many sellers over 55 can exclude up to $500,000 of gain when married filing jointly ($250,000 single). You generally need to have owned and used the home as your main residence for at least two of the past five years, and you can’t have used the exclusion in the last two years.

Partial exclusions may apply for health or other qualifying reasons, and prior business or rental use can trigger depreciation recapture. Review the rules and talk with your CPA before you accept an offer. See the IRS overview: Topic No. 701 — Sale of Your Home.

Proposition 19 Property Tax Transfer in Los Angeles: Who Qualifies, What Transfers, and How to Apply

A Proposition 19 property tax transfer Los Angeles sellers can use keeps your assessment low when you buy again. If you’re 55+, permanently disabled, or a victim of a disaster, you may transfer your taxable value to a replacement home anywhere in California, up to three times. Equal‑or‑lesser value transfers keep your base; higher‑value purchases add only the difference.

File the claim with the assessor where you buy, and complete the sale and purchase within two years (either order works). For statewide eligibility and how the “greater value” math works, see the California BOE Prop 19 page.

Quick example: “greater value” made simple

Sell for $1.2M with a $400k factored base; buy at $1.3M. Your transferred base remains $400k plus the $100k difference, so the new assessed value is roughly $500k—often a large annual tax savings.

Timing Matters: Best Time to Sell a Home in Santa Monica, Westchester, or Woodland Hills for Downsizing

Seasonality still helps—especially on the Westside. Recent analyses show sellers who list in late spring tend to achieve modest premiums, with momentum building from mid‑March through late May.

Local micro‑markets vary, but a late‑spring list can align with peak buyer activity and pleasant showing weather. For current data on national timing premiums that often mirror LA’s spring surge, see Zillow’s 2025 analysis: Spring Surge — higher returns begin in March, peak in late May.

Choose Your Sale Path: Cash Offer vs Traditional Listing in LA Real Estate

Speed vs. price is the core trade‑off. Cash offers can reduce showings and uncertainty, but they often discount for convenience. Traditional listings can attract multiple offers and better terms if the home is prepped and priced right.

If you’re fielding unsolicited “we buy houses” mailers, protect your equity and verify legitimacy. AARP outlines how these pitches work—and why they’re often below market: AARP’s guide to unsolicited “we’ll buy your home” offers.

When a quick cash sale can fit

If you need firm timing for a medical move or cross‑country relocation, speed may beat maximizing every last dollar. Ask your CPA to compare after‑tax proceeds under both paths before you decide.

Prep the Property: How to Downsize and Stage a Longtime Family Home Without Overwhelm

Declutter early, then stage the rooms buyers value most. Focus on the living room, kitchen, and primary bedroom; light, cleanliness, and simple vignettes help buyers imagine themselves in the space.

Light handyman fixes and a deep clean typically outperform major remodels right before listing. Data from the National Association of REALTORS® shows staging can reduce time on market and nudge value. Review highlights in NAR’s report: 2025 Profile of Home Staging.

Logistics and Move Plan: Sequencing the Sale, Rent‑backs, Bridge Options, and Storage

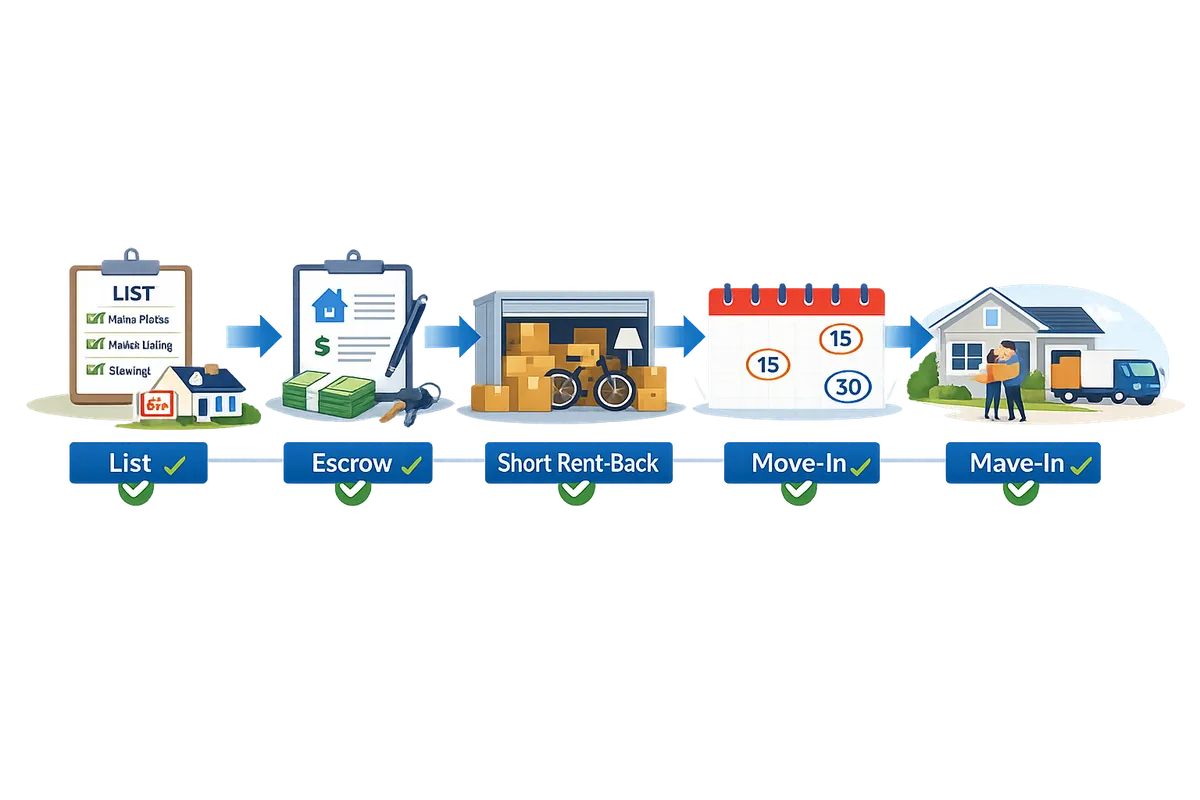

Sequence the deal so you never feel rushed. Decide if you’ll buy first, sell first, or use a short rent‑back (seller‑in‑possession) after closing. Your agent and escrow can structure timelines that align with your health and travel needs.

The California Association of REALTORS® periodically updates standard forms and advisories for sellers remaining in possession after close. Review recent updates here: C.A.R. forms release — rent‑backs and possession updates.

-

- Two‑track timeline: Prep and list while you identify likely replacement homes

- Rent‑back clarity: Define daily rate, deposit, insurance, and move‑out date in writing

- Bridge options: Discuss interim rentals or short‑term storage so closing day is calm

Relocation Strategy: Sell and Relocate Closer to Healthcare in Los Angeles or Near Family

Proximity to care reduces daily stress. Map distances to your primary doctor, specialists, and hospital ERs before you write an offer on your next home. Santa Monica, Westchester, and the Valley each offer strong medical options and quick freeway access.

Use the county’s locator to preview clinics and hospitals and confirm drive times at different hours: LA County “Find a Hospital or Clinic”.

Legal and Paperwork Checklist: Disclosures, Trusts, POAs, and Senior‑Focused Considerations

Clean paperwork prevents costly delays. Standard California packages include the Transfer Disclosure Statement (TDS), Natural Hazard Disclosure, and local forms. Trust sales require the correct signer (trustee) and, if used, verify any power of attorney with escrow early.

Review the statutory TDS form language to understand seller duties: California Civil Code §1102.6 — Transfer Disclosure Statement.

-

- Trust/estate docs: Trust certificate, death certificates (if applicable), and ID verifications

- Insurance/permits: Gather permits and receipts for significant work; confirm insurance during rent‑back

- Escrow funds: Wire only to verified instructions; request a test call‑back protocol

Risk Management: Avoiding Common Pitfalls, Scams, and Costly Tax Mistakes

Slow down on anything that feels rushed or opaque. Confirm license status, insist on written terms, and never accept last‑minute changes to wiring without a live call to escrow on a known number.

California’s Department of Real Estate publishes consumer alerts about fraud, mortgage crimes, and related risks. Read current advisories here: DRE Consumer Alert (Nov 3, 2025).

Build Your Team: Agent, CPA, Estate Attorney, and Move Manager for a Smooth Transition

The right team reduces decision fatigue. Pair a local listing agent who knows your neighborhood micro‑trends with a CPA and estate attorney who can coordinate tax timing, trust signatures, and inter‑family gifts.

For hands‑on decluttering, packing, and setup at the new place, consider a Senior Move Manager. Find vetted pros through the National Association of Senior & Specialty Move Managers: NASMM “Find a Move Manager”.

FAQs: Quick Answers for Empty Nesters in LA

Yes, you can transfer your property‑tax base if you buy first, then sell. Under Prop 19, as long as one transaction occurs on or after April 1, 2021 and you complete the other within two years, you may still qualify. Ask your assessor for forms and deadlines.

Usually, you can exclude up to $500,000 as a married couple ($250,000 single). You must meet the ownership and use tests, and there are special rules for health moves and prior business use. A CPA can ensure you report correctly and handle any depreciation.

Late spring is often the best time to list in coastal LA. Westside buyers ramp up from March, with many successful sales in May/June. If you’re downsizing, target a list date that lines up with your move‑in and any rent‑back.

A rent‑back can be safe when documented. Use a written seller‑in‑possession agreement with clear dates, deposits, and insurance language. Keep possession under 30 days to avoid creating a longer‑term tenancy.

Verify every pro before you sign. Check your agent’s license and any disciplinary history via the state portal: Verify a California real estate license.

Your Next Steps: Timeline, Decision Points, and How to Book a Free Consultation (Conclusion)

A careful plan lets you sell your Los Angeles area home with confidence—and land exactly where you want to be. Clarify your goals, confirm your net, and decide whether a traditional listing or a convenience‑driven cash offer best supports your priorities.

As you finalize timing, review tax rules (Section 121 exclusion and Prop 19 transfer) and keep wire instructions locked down. For a step‑by‑step tax guide to home sales, start with the IRS resource: Publication 523 — Selling Your Home. (irs.gov)

Set a call with us to map your target list date, staging plan, and move timeline. You keep more of your equity—and gain peace of mind—when you sell with a tax‑smart roadmap.

Want a custom, no‑pressure game plan? Book your free consultation.